BTC Price Prediction: Will Bitcoin Reach $100,000 Amid Current Market Conditions?

#BTC

- Bitcoin currently trades at $104,479.81, already above the $100,000 target level

- Technical indicators show mixed signals with bearish MACD but supportive Bollinger Band positioning

- Fundamental factors including institutional adoption and Fed liquidity provide underlying market support

BTC Price Prediction

Technical Analysis: Bitcoin Faces Resistance at Key Moving Average

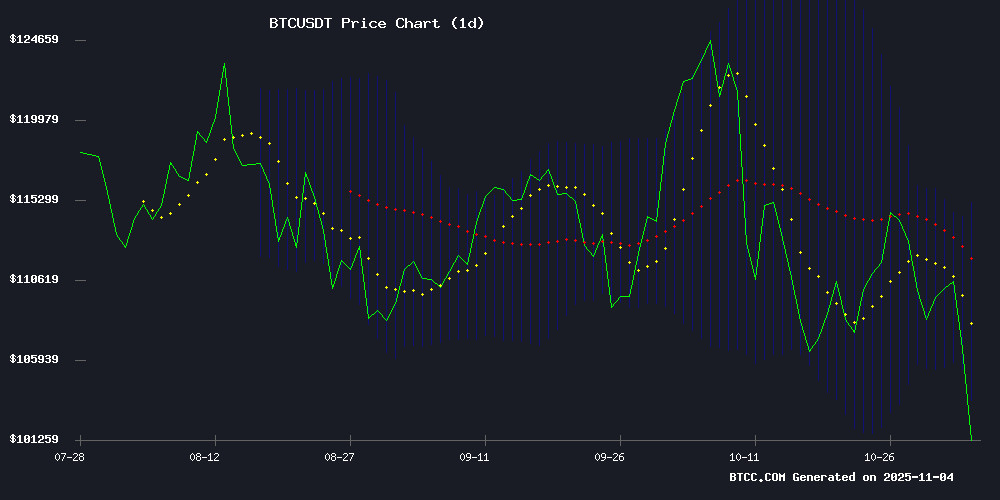

According to BTCC financial analyst William, Bitcoin's current price of $104,479.81 sits below the 20-day moving average of $109,539.98, indicating potential short-term resistance. The MACD reading of -1276.4337 shows bearish momentum, though the price remains within the Bollinger Band range between $104,523.39 and $114,556.57. William notes that holding above the lower band could provide support for a rebound toward the $100,000 psychological level.

Market Sentiment: Mixed Signals Amid Institutional Shifts

BTCC financial analyst William observes that recent news presents a complex picture for Bitcoin. While institutional adoption continues with miners pivoting to AI infrastructure and maintaining long-term commitments, concerns emerge from declining retail participation and regulatory attention. William suggests that the $29.4B liquidity injection by the Fed could provide underlying support, but traders should monitor the $1.15B in crypto liquidations and whale selling activity closely.

Factors Influencing BTC's Price

Bitcoin Mining Frenzy Strains Iran's Power Grid as Illegal Operations Surge

Iran's electricity infrastructure faces mounting pressure as a surge in unauthorized Bitcoin mining operations overwhelms the national grid. Akbar Hasan Beklou, CEO of Tehran Province Electricity Distribution Company, describes the situation as a "paradise for illegal miners," with subsidized power and clandestine setups fueling the boom.

Authorities estimate 427,000 active mining devices across Iran, 95% operating without licenses. This illicit network consumes approximately 1,400 megawatts continuously—prompting coordinated raids that shuttered 104 farms in Tehran alone. Some operations have grown sophisticated, hiding within industrial facilities or using tampered meters to avoid detection.

The economics prove irresistible: state-subsidized electricity prices create profit margins that persist even with 24/7 operation. Utility executives report cumulative seizures now reach hundreds of thousands of machines, though enforcement struggles to keep pace with the underground industry's scale.

$1.15B Crypto Liquidation: 208K BTC Vanish from Exchanges Amid Market Turmoil

The cryptocurrency market plunged into chaos as Bitcoin's sharp drop to $106,000 triggered a staggering $1.15 billion liquidation event. Long positions bore the brunt, accounting for nearly 90% of the losses, with Hyperliquid, Bybit, and Binance seeing the heaviest outflows.

Santiment's revelation that 208,000 BTC quietly exited exchanges over six months has intensified market anxiety. The silent exodus raises urgent questions about institutional movement and the market's structural stability.

Exchange data paints a grim picture: Hyperliquid suffered $333 million in liquidations, 98% from long positions. Bybit and Binance followed with $288 million and $223 million respectively, as traders scrambled to cover positions in the cascading sell-off.

Bitcoin Miners Pivot to AI Infrastructure, Fueling Stock Surges and Billion-Dollar Deals

Bitcoin mining companies are undergoing a radical transformation, emerging as key players in artificial intelligence infrastructure. Strategic partnerships with tech giants like Microsoft and Dell have unlocked billions in value, propelling stocks like IREN (formerly Iris Energy) up 580% since its November 2024 rebranding. Competitors including Riot Platforms, TeraWulf, and Cipher Mining have seen gains between 100-360% as Wall Street recognizes their repurposed energy and computing assets.

The sector's reinvention follows April 2024's Bitcoin halving, which compressed mining profitability. Geopolitical tensions are accelerating the trend, with U.S.-based firms gaining advantage through domestic infrastructure. What began as cryptocurrency operations now power the AI revolution—a testament to the fluidity of technological capital.

MicroStrategy Slows Bitcoin Purchases Amid Market Challenges, Maintains Long-Term Commitment

MicroStrategy has sharply reduced its bitcoin acquisitions, dropping to approximately 200 BTC per week—the lowest level since the company began its crypto accumulation strategy in 2020. The slowdown reflects tighter market conditions and constrained capital-raising opportunities via equities. Despite the pause, Executive Chairman Michael Saylor hints at future large-scale purchases, reaffirming Bitcoin's centrality to the firm's treasury strategy.

The deceleration marks a stark contrast to MicroStrategy's earlier aggressive buying, which often saw tens of thousands of BTC acquired in short bursts. Market observers interpret the shift as tactical rather than strategic, with the company awaiting clearer signals in a volatile macroeconomic landscape. "Bitcoin remains our primary hedge against monetary debasement," a company statement emphasized, dismissing speculation of a broader retreat from crypto.

Bitcoin In The Crosshairs: US Treasury Secretary Reveals What Senate Democrats Could Learn From BTC

Seventeen years after the Bitcoin whitepaper's release, US Treasury Secretary Scott Bessent highlighted BTC's resilience as a model for Senate Democrats. On the anniversary of the whitepaper's publication, Bessent pointed to Bitcoin's uninterrupted network activity through global crises as a lesson in consistency—a stark contrast to the ongoing federal budget clashes.

Bitcoin's decentralized framework, designed by Satoshi Nakamoto, has operated without central authority since 2009. Bessent's remarks, made via social media, framed BTC's 16-year track record as a benchmark for reliability amid political gridlock.

Bitcoin Retail Participation Plummets as Institutional Flows Dominate

Bitcoin's struggle to reclaim the $110,000 level has exposed growing fragility in its market structure. The cryptocurrency now probes lower demand zones as selling pressure builds, with traders recalibrating positions after recent volatility. While macroeconomic conditions remain favorable, thinning liquidity and receding speculative flows have shifted near-term sentiment toward caution.

A striking feature of this cycle is the dramatic retreat of retail investors. Analysis by Darkfost reveals small-holder inflows to Binance—measured through so-called 'shrimp deposits'—have collapsed from 552 BTC daily in early 2023 to just 92 BTC currently. This five-fold decline marks one of the steepest retail participation drops ever observed during a Bitcoin recovery phase.

The market's character has fundamentally changed. With retail investors sidelined, price action now reflects institutional flows, whale activity, and long-term accumulation patterns. The path forward hinges on whether fresh liquidity emerges or whether Bitcoin must first establish deeper support levels before its next upward leg.

OG Bitcoin Whale Selling Sparks Debate: Rotation Or Red Flag?

Veteran Bitcoin investors, often referred to as OG whales, are sparking market debates as they offload portions of their holdings. The MOVE raises a critical question: is this a strategic rotation amid Bitcoin's late-cycle strength, or a warning sign of eroding confidence in its core thesis?

Jeff Park, a former Bitwise executive, emphasizes the significance of these early adopters. "OGs are a special group of investors," he notes. "They saw something nobody saw before and took early risks at scale." Their selling behavior, Park argues, likely reflects concerns that are non-consensus, improbable, and existential—far from trivial profit-taking.

The discussion extends to Jordi Visser's concept of "Bitcoin's Silent IPO," framing this phase as a quiet redistribution of ownership rather than a speculative frenzy. Meanwhile, Bloomberg's Eric Balchunas acknowledges that early holders are indeed selling, dismissing conspiracy theories about ETF-driven paper Bitcoin.

Quantum Computing Emerges as Long-Term Threat to Bitcoin's Cryptographic Security

Bitcoin faces a theoretical but growing vulnerability from quantum computing advancements. Research breakthroughs from Google, IBM, and Caltech have revived discussions about "Q-Day"—the hypothetical moment when quantum systems could crack elliptic-curve cryptography underpinning Bitcoin's security.

Market psychology may amplify risks before actual technological capabilities materialize. crypto markets remain particularly sensitive to fear-based narratives, as demonstrated by a recent $50 million sell order that temporarily erased billions in market value across multiple assets.

The fundamental concern isn't immediate technological capability but eroding confidence. Should investors perceive Bitcoin's encryption as potentially vulnerable, preemptive withdrawals could trigger cascading liquidations regardless of actual quantum computing progress.

Fed Injects $29.4B Liquidity as Bitcoin Traders Anticipate Market Impact

The Federal Reserve deployed $29.4 billion through its Standing Repo Facility on October 31, marking the largest short-term liquidity injection since pandemic-era interventions. While ostensibly addressing money market strains, the move carries implications for risk assets—with Bitcoin traders speculating about a potential November rally.

Central banks globally are tightening monetary policies just as governments accelerate debt issuance, creating cash shortages. The Fed's overnight repo operation expanded bank reserves to $2.8 trillion, suppressing spiking short-term funding rates that had threatened credit market stability.

Market observers note the SRF mechanism—where the Fed lends against Treasury and mortgage-backed securities—functions as a pressure valve for financial systems. Such liquidity operations historically correlate with increased capital flows into alternative assets during periods of monetary expansion.

Will BTC Price Hit 100000?

Based on current technical and fundamental analysis, BTCC financial analyst William believes Bitcoin has a reasonable chance of testing the $100,000 level in the near term. The current price of $104,479.81 is already above this threshold, suggesting the more relevant question is whether Bitcoin can sustain above $100,000.

| Metric | Current Value | Signal |

|---|---|---|

| Current Price | $104,479.81 | Above Target |

| 20-day MA | $109,539.98 | Resistance |

| Bollinger Lower Band | $104,523.39 | Support Level |

| MACD | -1276.4337 | Bearish Momentum |

William emphasizes that while technical indicators show some bearish pressure, the fundamental landscape with institutional adoption and Fed liquidity provides underlying strength. The key will be whether Bitcoin can maintain support above the lower Bollinger Band and build momentum toward the moving average resistance.